Adaptive modelling in Taito Markbit examines shifting crypto motion and draws scattered behavioural elements into a stable analytical outline. Gradual refinement shapes inconsistent activity into a dependable sequence that preserves clarity even as behaviour fluctuates.

Dynamic measurement supported by Taito Markbit studies contrast between projected action and unfolding movement. Early deviations surface immediately, guiding recalculated alignment that converts unstable activity into a unified pattern designed for consistent evaluation.

Pattern referencing managed by Taito Markbit compares new structural formations with established analytical points. Each adjustment strengthens behavioural accuracy across shifting cycles and maintains steady interpretation during sudden environmental changes.

Timed behavioural review in Taito Markbit evaluates active market motion against prior analytical references. Structured comparisons maintain balanced interpretation as new conditions appear, supporting clear reasoning throughout evolving behavioural phases. Cryptocurrency markets are highly volatile and losses may occur.

Adaptive evaluation in Taito Markbit studies forward moving market signals against structured behavioural sequences arranged across layered timelines. Each calculated review strengthens analytical accuracy and supports stable interpretation across extended monitoring cycles.

Taito Markbit aligns current market indicators with validated behavioural checkpoints to maintain balanced structural logic. Each refinement phase enhances interpretive reliability by examining new signals against established patterns, enabling clear analytical outcomes without interacting with exchange systems or executing trades.

Taito Markbit applies structured verification cycles to refine predictive balance across evolving behavioural windows. Gradual recalibration maintains stable clarity between live analysis and reference datasets, supporting consistent reasoning throughout periods of heightened volatility. Cryptocurrency markets are highly volatile and losses may occur.

Taito Markbit organises structured replication of validated analytical models through controlled signal pathways. Each input is aligned to preserve timing, allocation, and interpretive accuracy. This approach ensures behavioural cohesion and consistent analytical output while operating independently from any crypto exchange connection.

Every analytical model guided by Taito Markbit is monitored through ongoing evaluation and comparative checkpoints that measure alignment with reference structures. This process reduces drift, reinforces clarity, and maintains stable interpretive outcomes. Real-time adjustments allow models to respond to evolving behavioural conditions without interacting with exchange systems.

Taito Markbit applies protective safeguards to every reflective process, ensuring operational precision at all stages. Controlled data management and encryption maintain integrity while layered verification ensures consistent interpretive reliability. This framework minimises risk and preserves analytical clarity without relying on any crypto exchange operations.

Taito Markbit consistently reviews past results to detect inconsistencies and prevent predictive drift. Each computational update ensures models remain aligned with validated behavioural standards, avoiding errors from outdated references.

Advanced filtering in Taito Markbit isolates significant structural signals from short-term fluctuations. Redundant noise is removed to maintain authentic behavioural patterns, supporting clear interpretation and steady analytical clarity across historical assessments.

Taito Markbit synchronises anticipated results with confirmed analytical outputs, adjusting weighting to ensure coherence between projected shifts and observed behaviours. This harmonised approach strengthens predictive consistency across successive analytical cycles.

Sequential review in Taito Markbit compares live data with structured reference frameworks. Continuous evaluation allows rapid recalibration and ensures models adapt efficiently to emerging behavioural trends.

Layered adaptive cycles in Taito Markbit integrate evolving behavioural patterns with structured verification. Each cycle reduces interpretive drift, reinforces reliable long-term outputs, and ensures steady analytical evidence over extended observation periods.

Taito Markbit leverages AI-driven analytics to detect subtle fluctuations in market behavior in real time. Multi-layer recognition isolates minor deviations and organizes scattered trading signals into a coherent analytical framework. Each refined evaluation enhances clarity and maintains stability amid rapidly changing market conditions.

The analytical framework in Taito Markbit converts each cycle into a dynamic learning reference. Contextual weighting combines past data with live computations to sustain continuous predictive alignment. Iterative processing strengthens pattern correlation, converting collected information into actionable insights for informed decision-making.

Continuous monitoring in Taito Markbit aligns real-time market activity with validated historical patterns. Adjustments improve analytical accuracy and maintain consistent interpretation. This adaptive approach provides a dependable foundation, ensuring structured and reliable insight across complex, fast-moving trading environments.

Taito Markbit leverages AI-powered automation to continuously track live market dynamics. High-frequency micro-trends are analysed and structured into consistent analytical flows. Each monitoring cycle ensures interpretive consistency, providing reliable insight during volatile market conditions.

Live data streams managed by Taito Markbit are processed seamlessly to maintain precision and stability. Automatic adjustments respond instantly to emerging signals, converting rapid market movements into coherent analytical insights. This ongoing evaluation sustains accuracy and dependable interpretation across dynamic trading periods.

Analytical layers inTaito Markbit merge multiple behavioural data streams into a unified view. Sequential filtering removes noise while maintaining continuous directional awareness. This harmonised process preserves interpretive consistency even during extended volatility and complex market scenarios.

Taito Markbit performs continuous evaluations to enhance precision across all analytical cycles. Predictive recalibration adjusts outputs to reflect evolving market patterns, supporting balanced insights and ensuring stability throughout active trading periods. Cryptocurrency markets are highly volatile and losses may occur.

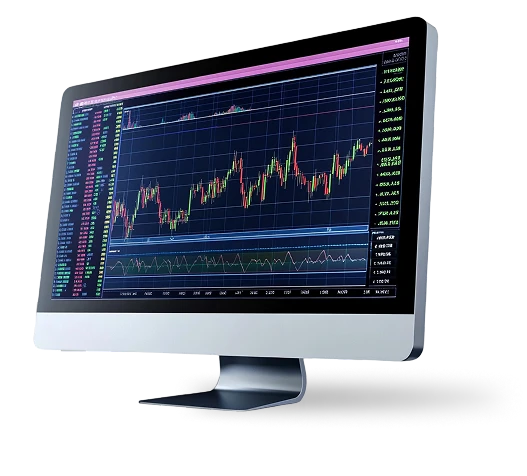

The interface ofTaito Markbit organises complex analytical inputs into structured visual displays. Balanced presentation converts layered data into clear, understandable formats, supporting smooth navigation and effortless interpretation across multiple analytical layers.

Interactive modules inTaito Markbit transform complex analytical feedback into fluid visual representation. Continuous adaptation ensures fast moving market activity remains traceable, maintaining clarity and interpretive stability under unpredictable conditions.

Taito Markbit continuously monitors market activity using AI driven computational assessment. Predictive analysis tracks trends and corrects deviations, maintaining steady performance during changing market conditions. Each analytical cycle ensures balanced interpretation and dependable clarity.

Layered systems inTaito Markbit identify differences between projected and actual outcomes. Controlled adjustments restore proportional structure while continuous signal review eliminates extraneous noise. This process preserves consistent analytical rhythm across dynamic market transitions.

Comparative alignment inTaito Markbit integrates predictive models with validated outcomes. Automated modulation detects divergences early, correcting potential drift and reinforcing structural consistency. Continuous refinement sustains dependable insight throughout active analytical cycles.

Taito Markbit applies high speed computational analysis to evaluate market movements in real time. Machine learning mechanisms detect subtle variations and convert micro level inputs into structured analytical sequences. Each refined layer maintains timing precision and interpretive stability across evolving conditions.

Adaptive automation inTaito Markbit translates immediate market signals into measurable analytical outputs. Early detection of fluctuations adjusts interpretive parameters, ensuring consistent accuracy throughout ongoing transitions. Each recalibration aligns assessment with validated data, supporting clarity and balance.

Layered computations inTaito Markbit provide ongoing oversight through continuous recalibration. Real time validation integrates live observation with contextual analysis, delivering reliable interpretation independently from trade execution.

Taito Markbit employs adaptive AI to analyze complex market behavior and deliver precise analytical insights. Each computational layer identifies interconnected trends, forming a stable interpretive framework that adjusts to evolving market conditions.

Iterative recalibration inTaito Markbit enhances analytical performance through ongoing optimization. Variable weighting improves responsiveness while filtering inconsistencies and preserving proportional integrity. Each adjustment reinforces clarity and dependable interpretation across diverse market environments.

Predictive modeling inTaito Markbit synchronizes historical trends with current observations. Accuracy develops progressively as validated insights accumulate, converting continuous learning into structured, actionable analytical outputs.

Taito Markbit maintains robust analytical structure by separating data driven insights from fluctuating market behavior. Each layer strengthens comprehension through refined sequencing, enhancing predictive calibration while preserving interpretive balance.

Verification modules inTaito Markbit confirm data consistency before results are produced. Each evaluation reinforces relational reasoning and proportional logic, supporting autonomous analytical operations across workflows.

Taito Markbit monitors coordinated market activity during live trading phases. Advanced algorithms quantify the intensity and velocity of collective behavior, converting dispersed market activity into structured insights that reflect overall market trends.

Predictive modeling inTaito Markbit identifies synchronized patterns emerging from dynamic market conditions. Layered evaluation measures participation and rhythm, transforming complex trading signals into a consistent analytical framework for accurate comprehension.

Algorithmic processes inTaito Markbit refine reactive market behaviors into proportional logic. Each stage minimizes distortions, ensuring analytical stability and supporting balanced insights during periods of heightened market activity.

Dynamic calibration inTaito Markbit evaluates concentrated behavioral surges, harmonizing trends through iterative refinement. Adjustments improve interpretation of group driven activity while maintaining clarity and stability. Cryptocurrency markets are highly volatile and losses may occur.

Taito Markbit applies adaptive calibration to maintain precise analytical interpretation, aligning predictive models with live market behavior. Forecasting modules evaluate deviations between expected and actual outcomes, converting differences into structured analytical insights.

Forward looking computation inTaito Markbit integrates predictive assessment with verified market data. Each refinement aligns forecasted patterns with observed trends, preserving interpretive clarity and structural consistency during volatile market conditions.